idaho sales tax rate 2020

The state general sales tax rate of Idaho is 6. Tax Rate.

Wyoming Sales Tax Small Business Guide Truic

Idaho has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 3.

. This includes hotel liquor and sales taxes. While the statewide sales tax rate is relatively high at 6 only a handful of cities charge. Other local-level tax rates in the state of Idaho are quite complex.

The maximum local tax rate allowed by Idaho law is 3. The Idaho ID state sales tax rate is currently 6. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Idaho local counties cities and special taxation.

A City county and municipal rates vary. Find detailed examples in our Idaho Residency Status and Idaho Source Income guides. The Boise sales tax rate is.

Idaho has a statewide sales tax rate of 6 which has been in place since 1965. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. Individual income tax is graduated.

Idaho sales tax rates vary depending on which county and city youre in which can make finding the right sales tax rate a headache. Find your Idaho combined state and local tax rate. The Idaho ID state sales tax rate is currently 6.

The base state sales tax rate in Idaho is 6. Municipal governments in Idaho are also allowed to collect a local-option sales tax that ranges from 0 to 3 across the state with an average local tax of 0074 for a total of 6074 when combined with the state sales tax. The County sales tax rate is.

With local taxes the total sales tax rate is between 6000 and 8500. Every 2021 combined rates mentioned above are the results of Idaho state rate 6 the Idaho cities rate 0 to 3. Plus 1125 of the amount over.

The average cumulative sales tax rate in the state of Idaho is 604. These rates are weighted by population to compute an average local tax rate. Plus 4625 of the amount over.

The December 2020 total local sales tax rate was also 6000. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Boise ID Sales Tax Rate.

Accuracy cannot be guaranteed at all times. The County sales tax rate is. The Idaho sales tax rate is.

Depending on local municipalities the total tax rate can be as high as 9. Idaho sales tax rate. ID Combined State Local Sales Tax Rate avg 604.

What is the sales tax in Idaho 2020. We strongly recommend using a sales tax calculator to determine the exact sales tax amount for your location. Did South Dakota v.

Sales tax rates are subject to change periodically. As far as other counties go the place with the highest sales tax rate is Blaine County and the place with the lowest sales tax. Idaho has a 6 statewide sales tax rate but also has 112 local tax jurisdictions including cities towns counties and special districts that collect an average local sales tax of 0074 on top of the state tax.

278 rows Idaho Sales Tax. Object Moved This document may be found here. Local tax rates in Idaho range from 0 to 3 making the sales tax range in Idaho 6 to 9.

Depending on local municipalities the total tax rate can be as high as 9. Average Sales Tax With Local. The Alabama sales tax rate is currently.

Local level non-property taxes are allowed within resort cities if approved by 60 majority vote. The most populous county in Idaho is Ada County. The Idaho sales tax rate is currently.

There are a total of 112 local tax jurisdictions across the state collecting an average local tax of 0074. Plus 6625 of the amount over. The minimum combined 2022 sales tax rate for Idaho Alabama is.

This is the total of state county and city sales tax rates. This is the total of state county and city sales tax rates. The Idaho state sales tax rate is 6 and the average ID sales tax after local surtaxes is 601.

The state sales tax rate in Idaho is 6000. State Local Sales Tax Rates As of January 1 2020. EIN00046 12-21-2020 Page 54 of 63 15000 Your tax is 18000 Your tax is 21000 Your tax is 15000 15050 770 532 18000 18050 978 724 21000 21050 1186 923.

What is the Idaho state tax rate for 2020. Prescription Drugs are exempt from the Idaho sales tax. 31 rows The state sales tax rate in Idaho is 6000.

With local taxes the total. Plus 3125 of the amount over. Idaho has one of the lowest average total sales tax rates of any state.

Plus 3625 of the amount over. The current total local sales tax rate in Boise ID is 6000. Plus 5625 of the amount over.

This takes into account the rates on the state level county level city level and special level. The minimum combined 2022 sales tax rate for Boise Idaho is. Cities andor municipalities of Idaho are allowed to collect their own rate that can get up to 3 in city sales tax.

ID State Sales Tax Rate. Nonresidents of Idaho must file if their total gross income from Idaho sources is more than 2500. This means that Idaho taxes higher earnings at a.

Counties and cities can charge an additional local sales tax of up to 25 for a maximum possible combined sales tax of 85. A sales tax table is a printable sheet that you can use as a reference to easily calculate the sales tax due on an item of any price - simply round to the nearest 020 and find the row in the sales tax chart that shows the applicable tax for that amount. Idaho state income tax rate table for the 2020 2021 filing season has seven income tax brackets with ID tax rates of 1125 3125 3625 4625 5625 6625.

Wayfair Inc affect Idaho. The state sales tax rate in Idaho is 6 but you can customize this table as needed to reflect your applicable local sales tax rate. California 1 Utah 125 and Virginia 1.

Is Idaho a low tax state. Income tax rates range from 1 to 65 on Idaho taxable income. What is the sales tax in Idaho 2020.

B Three states levy mandatory statewide local add-on sales taxes at the state level.

Tobacco Cigarette Tax By State 2022 Current Rates In Your Jurisdiction

Idaho Income Tax Calculator Smartasset

State Corporate Income Tax Rates And Brackets Tax Foundation

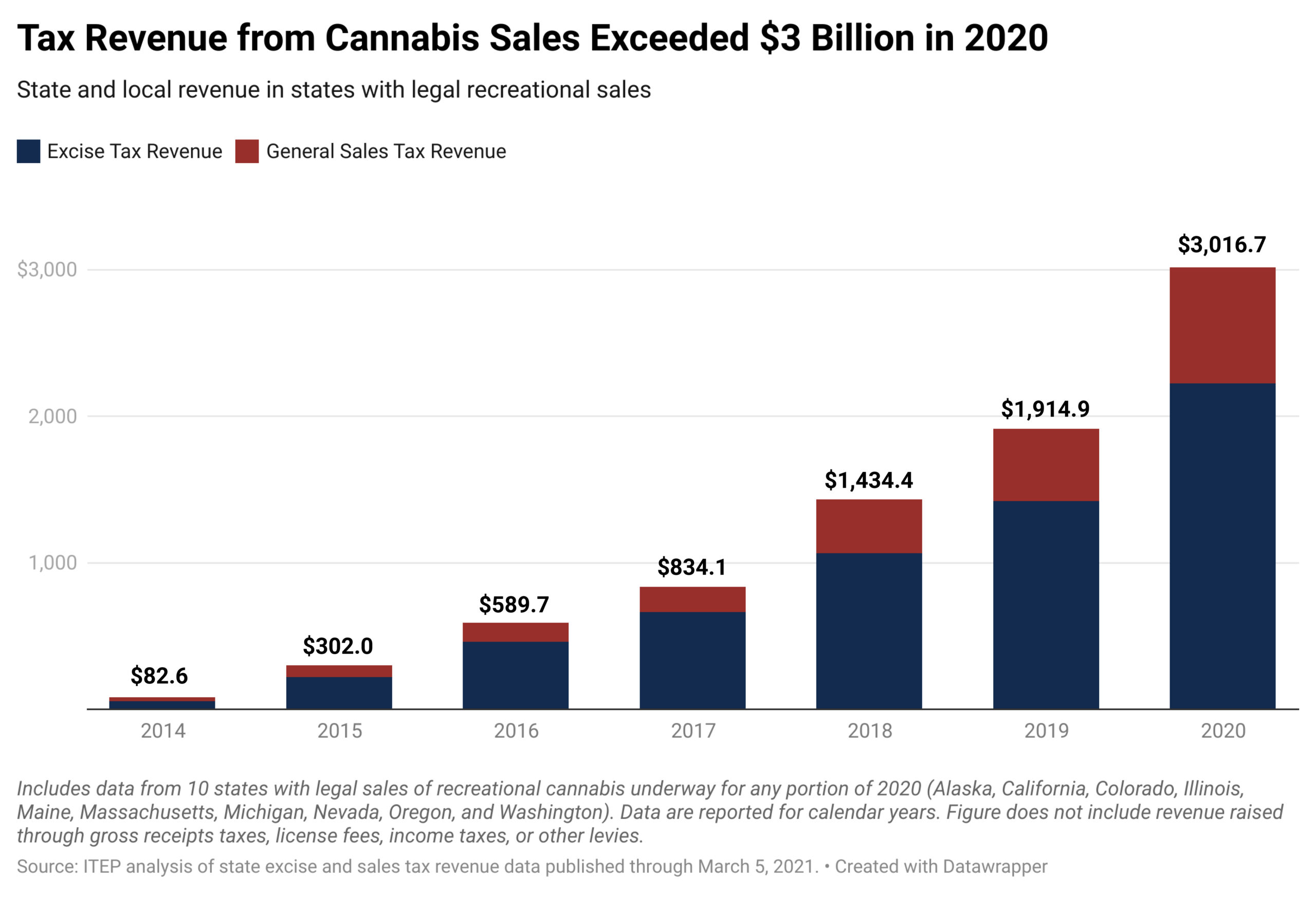

State And Local Cannabis Tax Revenue Jumps 58 Surpassing 3 Billion In 2020 Itep

Idaho Sales Tax Guide And Calculator 2022 Taxjar

2022 Sales Taxes State And Local Sales Tax Rates Tax Foundation

Economic Nexus Laws By State Taxconnex

Historical Idaho Tax Policy Information Ballotpedia

Idaho House Passes 600 Million Income Tax Cut And Tax Rebate Bill Idaho Capital Sun

Idaho Sales Tax Rates By City County 2022

Idaho Tax Rates Rankings Idaho State Taxes Tax Foundation

States With Highest And Lowest Sales Tax Rates

State Corporate Income Tax Rates And Brackets For 2022 Tax Foundation

How High Are Cell Phone Taxes In Your State Tax Foundation